Climate Risk. A key element of ESG management.

RainbirdGEO provides science-based, practical solutions to climate challenges.

Climate risk response — act now or pay more later.

What is climate risk?

→ The potential threat to the financial sector caused by physical damages from extreme weather events or by business deterioration during the transition to a low-carbon economy.

Physical Risk

ㆍEconomic costs and financial losses resulting from the increasing frequency of extreme weather events such as typhoons, floods, and heatwaves, as well as long-term shifts in climate patterns

ㆍImpacts arising from weather phenomena and broader environmental changes

Transition Risk

ㆍPotential financial losses resulting from a rapid transition to a low-carbon economy

ㆍLosses that may arise during the adjustment process toward a sustainable economy, driven by changes in public policy, disruptive technological innovation, and shifts in customer and investor preferences

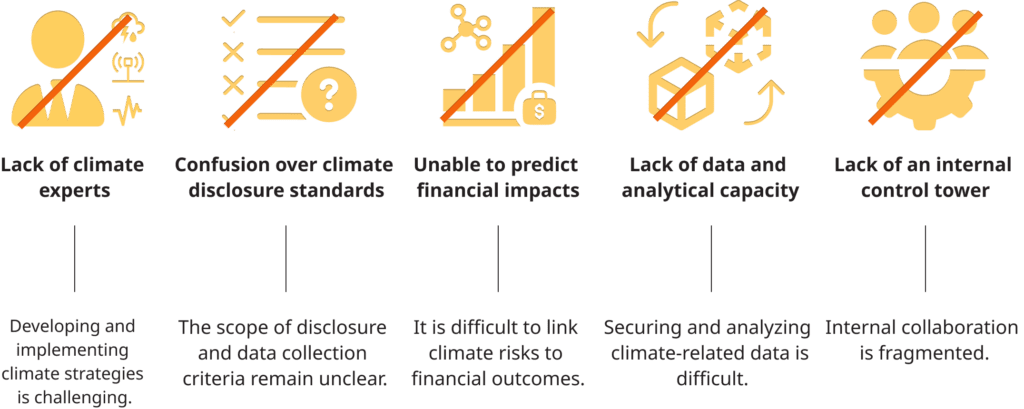

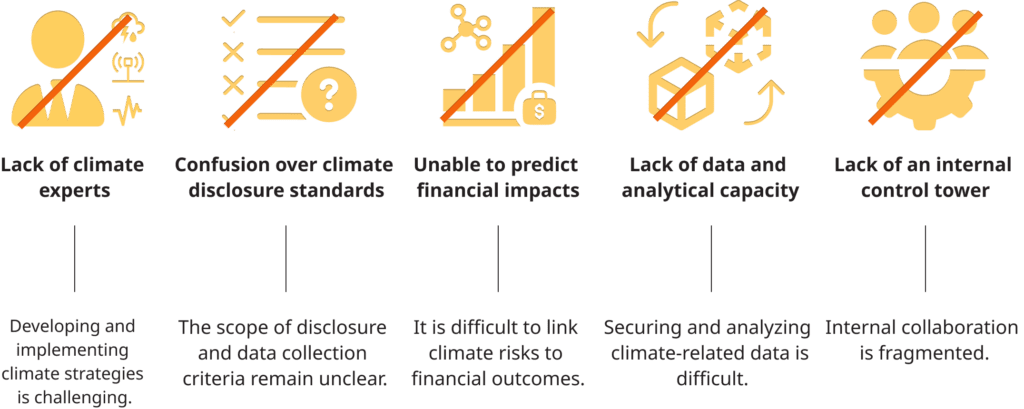

Has managing climate risk been challenging for non-expert companies like yours?

We've compiled common concerns raised in the field.

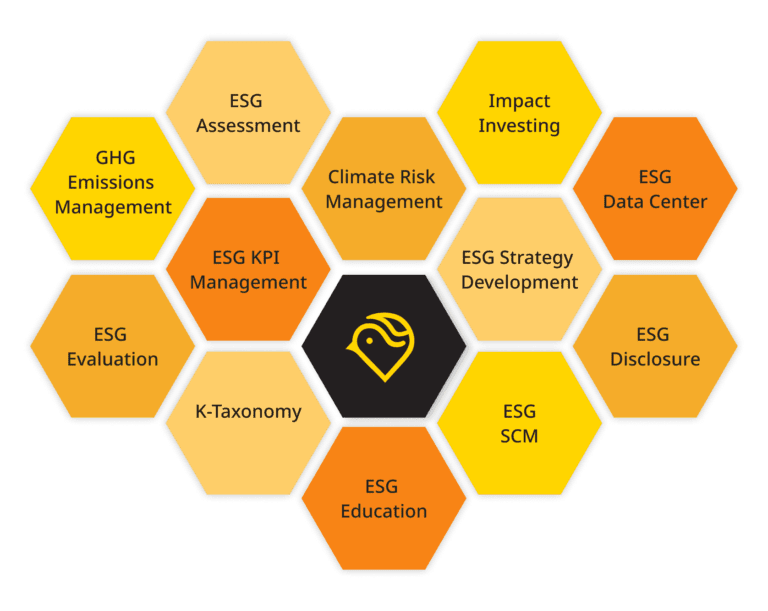

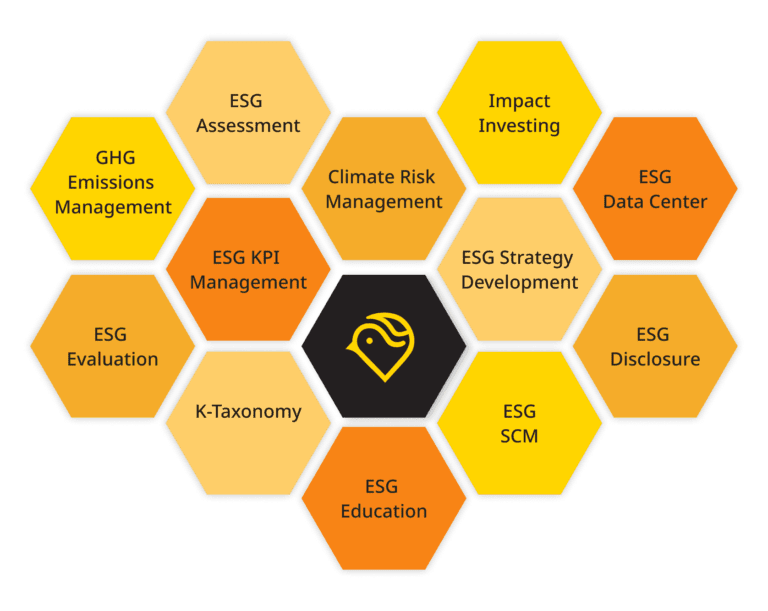

RainbirdGEO’s ESG solutions complete the puzzle of ESG management.

We offer customized solutions for every department and organization — covering ESG KPIs, climate risk, supply chains, disclosures, evaluations, and education.

RainbirdGEO ESG Solutions

RainbirdGEO provides tailored ESG solutions to support the sustainable management of our clients.